Who Pays Property Taxes When Selling House . Property tax is an annual tax levied on property owners in singapore. This amount is payable in. Payment is due on 31 jan. When and how do i pay property tax? There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. You need to submit the official tax payment receipt. At the end of each year, you will receive your property tax bill for the following year. Property tax is payable yearly. Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding. As the seller, you need to pay the flat’s property tax up to the end of the year. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. Upon selling your property, you must pay a prorated amount for the remaining year.

from llsellssd.com

Payment is due on 31 jan. Property tax is an annual tax levied on property owners in singapore. This amount is payable in. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. At the end of each year, you will receive your property tax bill for the following year. You need to submit the official tax payment receipt. When and how do i pay property tax? Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding. Property tax is payable yearly. There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and.

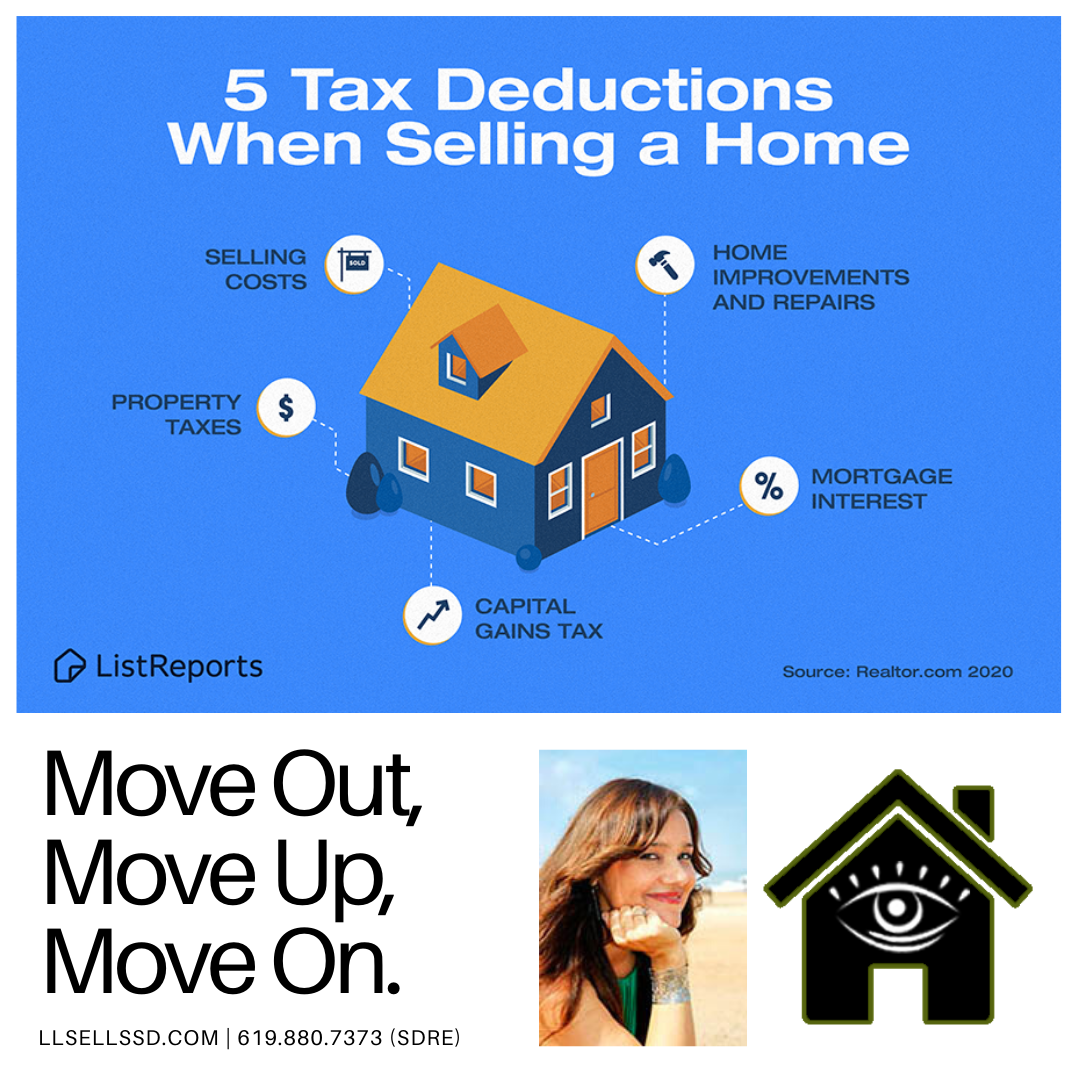

5 Tax Benefits from Selling a Home San Diego Realtor, Listing Agent

Who Pays Property Taxes When Selling House Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding. Payment is due on 31 jan. Property tax is an annual tax levied on property owners in singapore. There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. At the end of each year, you will receive your property tax bill for the following year. As the seller, you need to pay the flat’s property tax up to the end of the year. You need to submit the official tax payment receipt. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. When and how do i pay property tax? This amount is payable in. Upon selling your property, you must pay a prorated amount for the remaining year. Property tax is payable yearly. Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding.

From www.housingwire.com

Property taxes on singlefamily homes increase 6 in 2017 HousingWire Who Pays Property Taxes When Selling House There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. At the end of each year, you will receive your property tax bill for the following year. Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed. Who Pays Property Taxes When Selling House.

From www.fintoo.in

How To Save Tax On Sale Of Residential Property In India? Fintoo Blog Who Pays Property Taxes When Selling House Property tax is payable yearly. Property tax is an annual tax levied on property owners in singapore. You need to submit the official tax payment receipt. This amount is payable in. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. Ssd is payable on all residential properties. Who Pays Property Taxes When Selling House.

From www.carringtonaccountancy.com

Selling a second home? Beware of the Capital Gains Tax change Who Pays Property Taxes When Selling House There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. This amount is payable in. When and how do i pay property tax? Upon selling your property, you must pay a prorated amount for the remaining year. You need to submit the official tax payment receipt. Property tax. Who Pays Property Taxes When Selling House.

From chucksplaceonb.com

Real Estate Taxes vs Property Taxes What Are the Differences? Chuck Who Pays Property Taxes When Selling House You need to submit the official tax payment receipt. Property tax is payable yearly. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. At the end of each year, you will receive your property tax bill for the following year. Upon selling your property, you must pay. Who Pays Property Taxes When Selling House.

From dailysignal.com

How High Are Property Taxes in Your State? Who Pays Property Taxes When Selling House You need to submit the official tax payment receipt. Property tax is an annual tax levied on property owners in singapore. At the end of each year, you will receive your property tax bill for the following year. When and how do i pay property tax? Property tax is payable yearly. Ssd is payable on all residential properties and residential. Who Pays Property Taxes When Selling House.

From sundae.com

What Taxes Do You Pay When Selling a House? Sundae Who Pays Property Taxes When Selling House As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. You need to submit the official tax payment receipt. This amount is payable in. As the seller, you need to pay the flat’s property tax up to the end of the year. Property tax is an annual tax. Who Pays Property Taxes When Selling House.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Who Pays Property Taxes When Selling House This amount is payable in. As the seller, you need to pay the flat’s property tax up to the end of the year. You need to submit the official tax payment receipt. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. Upon selling your property, you must. Who Pays Property Taxes When Selling House.

From www.sellmyhousefast.org

Quick Sales Guide Sell My House Fast the fastest way to sell your house Who Pays Property Taxes When Selling House This amount is payable in. Upon selling your property, you must pay a prorated amount for the remaining year. As the seller, you need to pay the flat’s property tax up to the end of the year. Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within. Who Pays Property Taxes When Selling House.

From cincyland.com

How Property Taxes Can Impact Your Mortgage Payment Commercial Who Pays Property Taxes When Selling House When and how do i pay property tax? As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. This amount is payable in. Payment is due on 31 jan. You need to submit the official tax payment receipt. At the end of each year, you will receive your. Who Pays Property Taxes When Selling House.

From ibuyer.com

What Are The Tax Implications of Selling a House? Who Pays Property Taxes When Selling House When and how do i pay property tax? At the end of each year, you will receive your property tax bill for the following year. Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding. Payment is due on 31 jan. There is a checklist. Who Pays Property Taxes When Selling House.

From www.cleveland.com

How Property Taxes Can Affect Your Selling Price Who Pays Property Taxes When Selling House This amount is payable in. As the seller, you need to pay the flat’s property tax up to the end of the year. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. When and how do i pay property tax? Ssd is payable on all residential properties. Who Pays Property Taxes When Selling House.

From swanwealth.com

Estate Tax Loss Swan Wealth Who Pays Property Taxes When Selling House There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. Payment is due on 31 jan. You need to submit the official tax payment receipt. This amount is payable in. Upon selling your property, you must pay a prorated amount for the remaining year. Property tax is payable. Who Pays Property Taxes When Selling House.

From www.prudentialcal.com

How Do Property Taxes Work When You Buy A House? Prudential Cal Who Pays Property Taxes When Selling House Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding. This amount is payable in. When and how do i pay property tax? Property tax is an annual tax levied on property owners in singapore. Payment is due on 31 jan. There is a checklist. Who Pays Property Taxes When Selling House.

From www.owebacktaxesproperty.com

What Happens if You Can't Pay Your Property Taxes? — Can I Sell My Who Pays Property Taxes When Selling House Property tax is payable yearly. There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. This amount is payable in. As the seller, you need to pay the flat’s property tax up to the end of the year. Payment is due on 31 jan. You need to submit. Who Pays Property Taxes When Selling House.

From www.youtube.com

Are there taxes on selling a house? YouTube Who Pays Property Taxes When Selling House Payment is due on 31 jan. This amount is payable in. Property tax is an annual tax levied on property owners in singapore. Property tax is payable yearly. There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. As a lien on the property, the taxing authorities can. Who Pays Property Taxes When Selling House.

From collateralanalytics.com

The Story of Entry Level Housing Affordability in the USA Considering Who Pays Property Taxes When Selling House Property tax is an annual tax levied on property owners in singapore. Property tax is payable yearly. As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. At the end of each year, you will receive your property tax bill for the following year. You need to submit. Who Pays Property Taxes When Selling House.

From www.nashvillesmls.com

How Property Taxes Can Influence a Home Purchase Who Pays Property Taxes When Selling House This amount is payable in. Upon selling your property, you must pay a prorated amount for the remaining year. Property tax is payable yearly. Ssd is payable on all residential properties and residential lands that are acquired on or after 20 feb 2010 and disposed of within the holding. Payment is due on 31 jan. Property tax is an annual. Who Pays Property Taxes When Selling House.

From www.realestatespokane.com

Property Taxes 101 Information for Home Buyers Who Pays Property Taxes When Selling House As a lien on the property, the taxing authorities can sell off the rights to collect on the amount owed and the. This amount is payable in. There is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro payments and. Upon selling your property, you must pay a prorated amount for. Who Pays Property Taxes When Selling House.